- 비트코인의 최근 반등이 64,000달러에 도달해 시장 낙관론이 더해졌습니다.

- Ichimoku Cloud와 같은 기술 지표는 약세장을 나타냅니다.

최근 비트코인 상승세에도 불구하고 [BTC[ market value, the king coin’s journey back to the $64,000 mark is shadowed by enduring concerns that could potentially dampen the optimism surrounding its recovery.

Though this recent reclaim of the $64,000 mark indicates further upward movement for its price, However, an analyst has given reasons why traders should remain cautious despite the apparent bullish signs.

A fragile recovery amidst optimism

Bitcoin’s resilience is often a barometer of market health. Recently, Bitcoin demonstrated a semblance of recovery, gaining 2.4% over the past week, and marking a modest increase of 0.6% in just the past 24 hours.

These gains have propelled Bitcoin to once again touch the $64,000 threshold—a level viewed as a critical indicator of potential upward trajectories.

However, the celebration of this milestone may be premature as underlying issues loom.

The recovery comes as BTC records a 13% drop from its peak in March, suggesting that the path to recovery could be fraught with volatility.

The recent gains, although encouraging, represent a delicate balance in a market still recovering from previous setbacks.

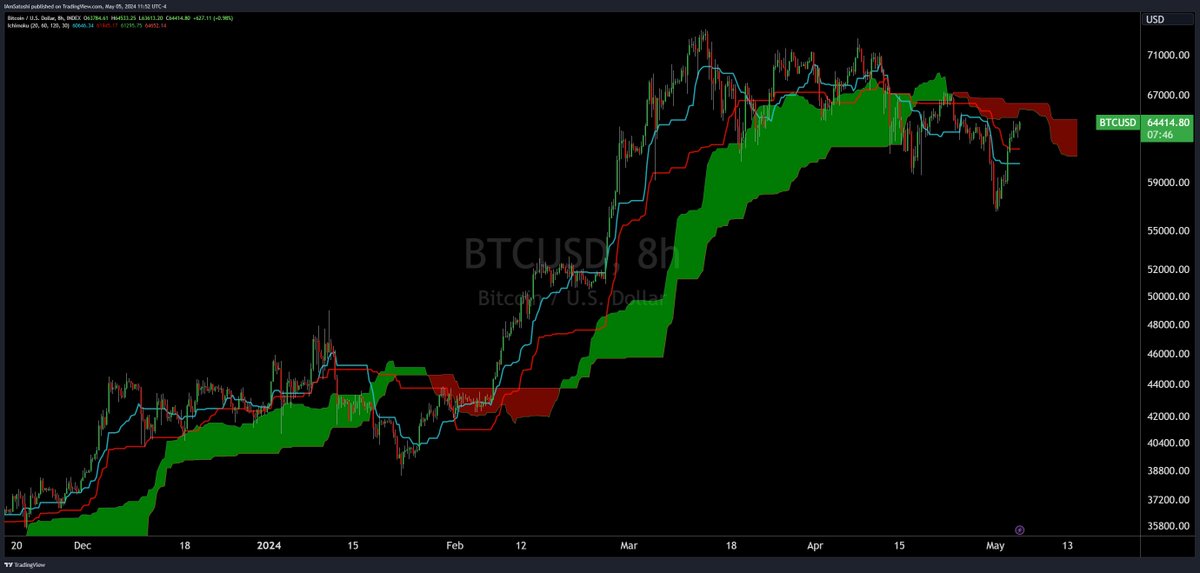

Josh Olszewicz, a seasoned trader, pointed out that despite Bitcoin’s ascent above $64,000, the cryptocurrency is not quite out of danger.

Source: TradingView

His analysis employs the Ichimoku Cloud, a complex indicator that provides a multifaceted view of market momentum and potential resistance and support levels.

Currently, the cloud remains red as shown above, signaling that the bearish trend is still dominant, with Bitcoin trading below this crucial indicator, which now acts as a significant barrier.

The Ichimoku Cloud suggests a continuation of bearish momentum unless Bitcoin can sustainably break above this cloud, transforming it from a resistance to a support zone.

Olszewicz recommends watching for a potential bullish confirmation through the inverse head and shoulders pattern alongside the cloud dynamics, which could indicate a stronger reversal from the bearish trend.

Where will Bitcoin head next?

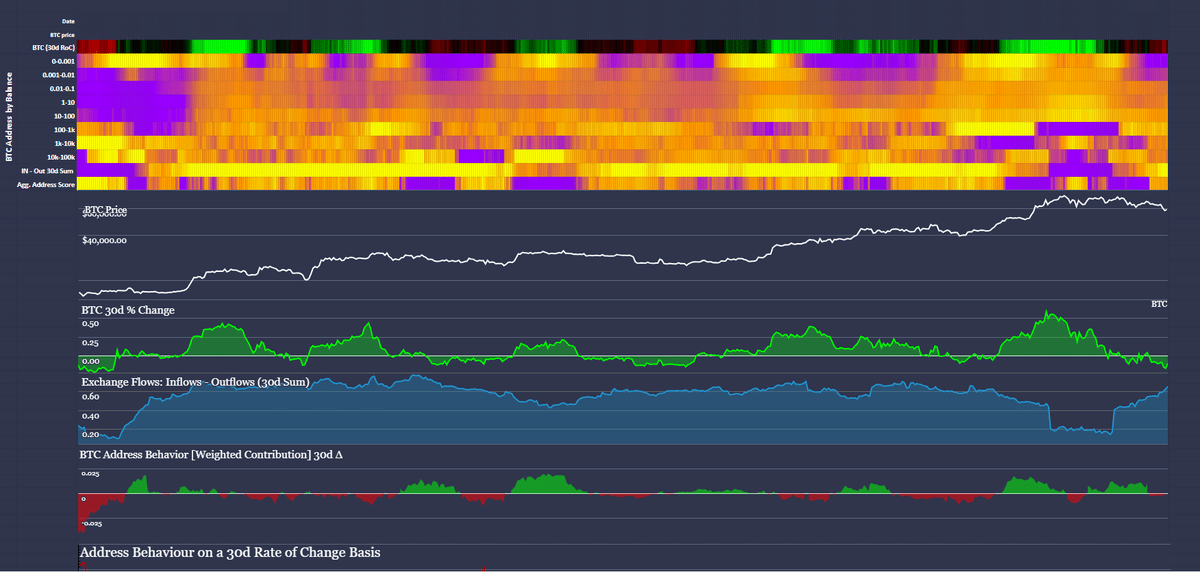

Further complicating the narrative, data from the analytics firm Santiment underscored a more nuanced perspective.

It suggested that while there are signs of distribution, the overall wallet activity indicates robustness without significant structural weaknesses.

This could mean that while immediate gains are visible, the broader market sentiment remains cautiously optimistic.

Source: Santiment

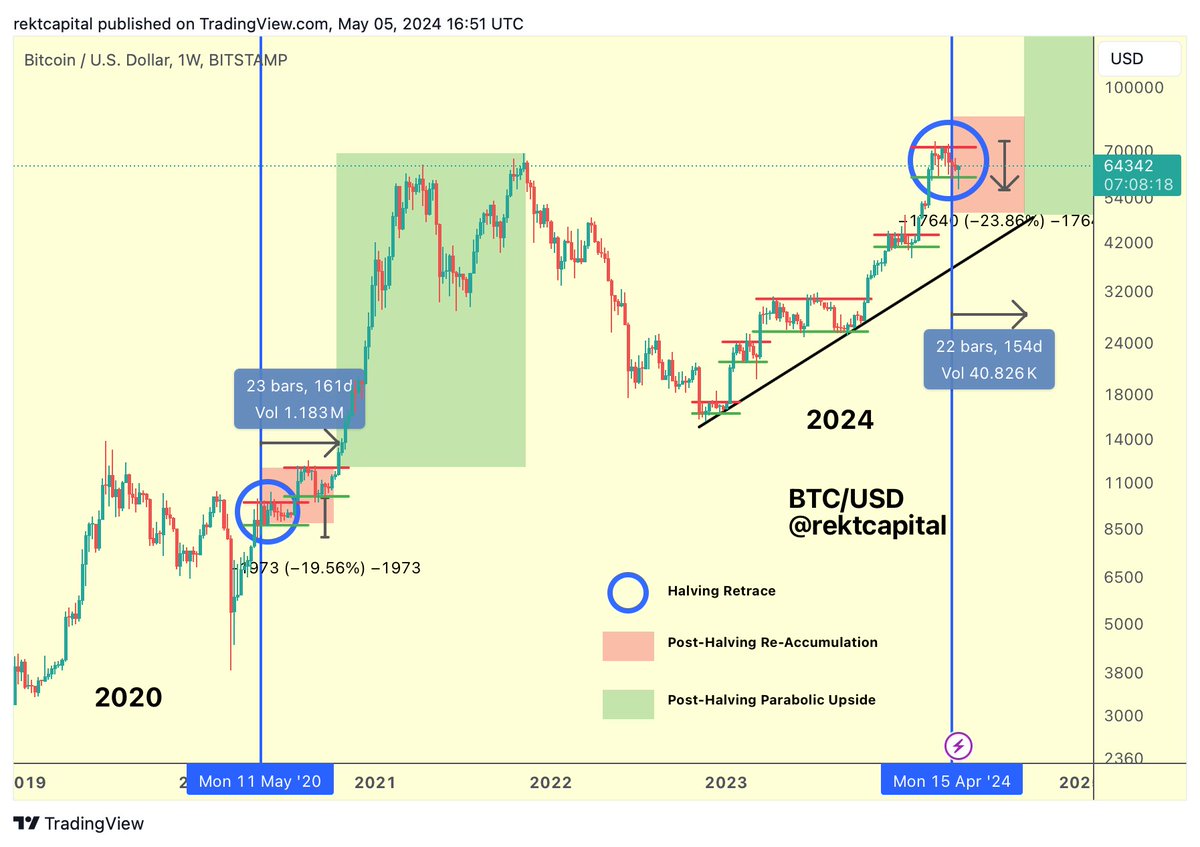

Moreover, according to crypto analyst Rekt Capital, Bitcoin is transitioning from a price-based capitulation to a time-based consolidation phase post-Halving.

This aligns with historical patterns that typically precede substantial bullish runs.

This phase, expected to last over 150 days, might be setting the stage for a more sustained growth period, echoing past cycles where prolonged consolidation led to robust upward movements.

Source: X

Read Bitcoin’s [BTC] 가격 예측 2024-2025

복잡성을 더하는 것은 AMBCypto의 존재입니다. 최근 보고서 하락쐐기형 패턴에서 벗어나면서 매수 모멘텀이 증가했음을 나타내는 긍정적인 신호를 보였습니다.

이는 역사적으로 가격 인상과 관련된 유리한 영역 내에서 비트코인 준비금 위험이 증가하는 강세 신호를 나타내는 Glassnode 데이터에서도 뒷받침됩니다.

“음악 팬. 매우 겸손한 탐험가. 분석가. 여행 괴짜. 익스트림 TV 전문가. 게이머.”